Thanks to blockchain technology, we are moving toward a trustless economy, with no need of third parties to exchange goods. Yet today’s digital currency exchanges are centralized. They have proven to be vulnerable to hacks, to react poorly to unusual blockchain events like hard forks, and often run with a high regulatory risk. Centralized exchanges keep their systems off-chain, meaning they operate as escrows for their clients, and transactions are not recorded on the blockchain. As a result, a centralized exchange will never provide the same security which stems from a distributed network of peers. This leads to massive breaches of security and unsafe storage of information, funds, and private keys.

A proposed solution is decentralized cryptocurrency exchanges whereby the architecture of the platform has no central controlling server (or bundle of servers). As a result, no third-party escrow intermediary is required to hold the funds of the participants in the exchange transaction.

One such exchange is NEX which we will review below.

NeonExchange ICO Overview.

NEX is a platform for complex decentralized cryptographic trade and payment service creation. NEX combines the NEO blockchain with an off-chain matching engine to enable much faster and more complex trades than existing decentralized exchanges.

- High Volume. NEX handles enormous trade volume through its unique publicly verifiable off-chain matching engine.

- Payment Service. The NEX payment service enables third-party smart contracts on NEO to send and receive global assets such as NEO and GAS as part of their computation.

- Complex Trades. NEX handles complex order types that aren’t currently available on other decentralized exchanges such as market and limit orders.

NEX token gives back profits, but has to be staked.

Market.

NEX is planning to venture into the decentralized exchanges market. Decentralized exchanges have several merits and demerits as below:

Merits.

- In a centralized exchange platform users make deposits to the exchange in order to facilitate an exchange/trading transaction. In a decentralized cryptocurrency exchange platform, users transact directly with their peers without the need for a central server. There is a no centralized platform service that is in possession of order books and custody. Funds are therefore controlled by the users and participants in the platform.

- The removal of the third-party authenticator drastically reduces fees and lag time before buy/sell orders are processed.

- Because it is a decentralized exchange, there is no single point of entry, just like a blockchain. As such, a hacker will need to compromise more than half of the network to be able to commandeer the system.

- A number of decentralized exchanges offer seamless integration with popular hardware wallets like Trezor and Ledger Nano S which ensures a much safer transaction space. Users can send coins directly from their hardware wallets to the smart contract of many decentralized exchanges.

- Government taxation or fund confiscation can become nearly impossible.

Demerits.

- The plethora of smart contracts that need to be navigated to use most decentralized exchanges can be dizzying even for a tech-savvy individual not to talk of someone who isn’t familiar with smart contracts.

- Most DEXs will not take credit or debit card or bank-transfer payment.

- Trading volume is limited which can keep prices low and fees high.

- The services available from decentralized exchanges are limited. Margin trading, stop losses and trades involving fiat currencies are usually not offered.

- There may be no customer service you can contact when there is a problem.

- A DEX can be much more expensive than a centralized exchange because you may need to purchase Ethereum Gas (Ethereum services) every time you make a trade. That means a decentralized trade can sometimes cost several times what a centralized trade would.

- Maintain the same scalability problems as the underlying blockchain.

- Transactions take time to be validated on blockchains

- Some services have to remain off-chain and have to suffer from limitations of centralized infrastructures

- Miners can preview transactions, since they validate them, and can have consequences on any DEX

- Need for fiat integrations and stable tokens for lower volatility.

- Current implementations of decentralized exchanges are slow due to low liquidity.

- Already existing decentralized exchanges like Etherdelta host order books on the blockchain to provide security. Hosting order books on chain slows down trading when the used blockchains themselves have scaling problems.

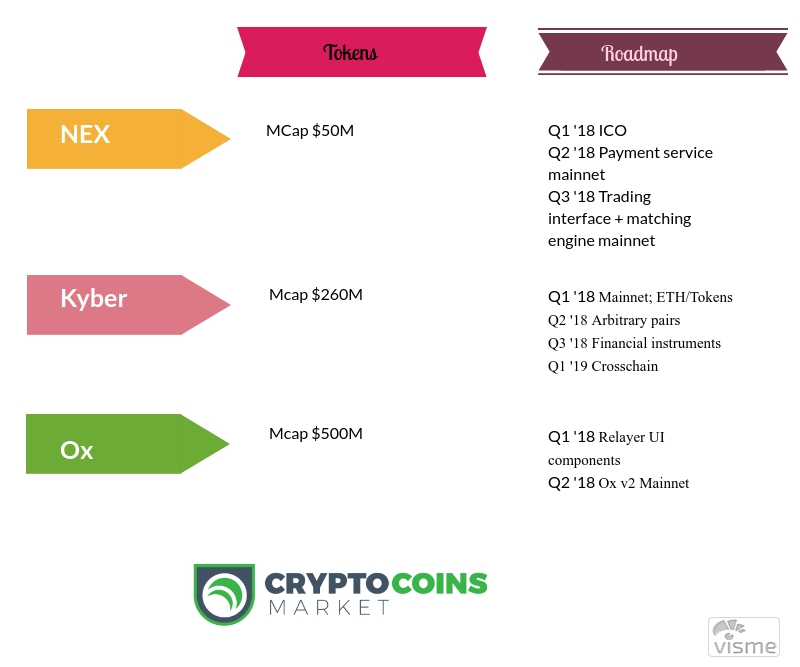

Here are similar products in the market:

- EtherDelta

EtherDelta leaves control of funds completely in control of the users. That said, in order to use EtherDelta funds need to be moved into the smart contract. Funds are essentially pooled together in the smart contract, but yet it’s all done on a distributed ledger. Confusing I know. The bottom line is that at any point in time a user can withdraw or deposit funds without any third party intervention.

Etherdelta hosts order books on the blockchain to provide security. Hosting order books on chain slows down trading when the used blockchains themselves have scaling problems. For example, hosting, modifying or cancelling an order on the Ethereum blockchain will cost gas on the Ethereum blockchain.

0x Protocol is a decentralized exchange platform for ERC20 tokens that facilitates instant off-chain ordering relays together with on-chain settlements. The reason for the dichotomy between order and settlements in the 0x Protocol is due to the desire to cut down on ether gas fees and make decentralized exchange transactions more efficient. All non-settlement activities are essentially handled outside of the blockchain with the actual value exchange activity occurring on the blockchain.

In theory, the hosting of order books by relayers is meant to provide the necessary liquidity for trading. Relayers provide automated smart contracts where users can store their assets until their particular order gets filled by a taker. Unlike in centralized exchanges, relayers no longer control the assets that are being traded on the exchange, but only host order books with liquidity provided by the end users. For the hosting of order books relayers receive fees in the 0x protocol native currency ZRX. Over time the competition of various relayers will lower prices.

Technically, big centralized exchanges like Coinbase and Bitfinex could become future relayers on the 0x protocol. This would guarantee that users still remain in control of their funds due to the non-custodial nature of the 0x protocol while benefiting from shared liquidity pools.

Kyber Network is a decentralized exchange platform that enables instant on-chain exchange of cryptocurrencies. It shares a lot of similarities with the 0x Protocol in terms of what it aims to achieve with the main distinction being that all of its activities are carried out on-chain. Kyber Network also aims to address the low liquidity problem that has affected a number of decentralized cryptocurrency exchanges which makes them unable to facilitate trading activities on the go. The project also attempts to minimize the high cost associated with maintaining the order book of a decentralized exchange on the blockchain.

One integral part of the Kyber Network ecosystem is the Dynamic Reserve Pool which is used to maintain liquidity. The network is designed such that there are always a number of entities in the pool so that centralization doesn’t occur and the exchange rates are kept competitive. Upon receiving an exchange request from a user, the smart contract protocol facilitates the exchange using the best available rate for the user.

Preventing centralization is a key aspect of the Kyber Network architecture. As a result, a number of safeguards have been put in place to prevent the occurrence of centralization within the network.

KNC is a buyback and burn token.

Its first mainnet was scheduled to launch on 31st March 2018.

4. Airswap.

Peer-to-peer protocol for trading Ethereum tokens, without order books. Users are supposed to match off-chain and settle the transaction on-chain. The way users are able to find each other on the exchange ecosystem is through a so-called indexer. The indexer aggregates intentions to trade which does not include the running of an order book.

Once the taker has gathered information on potential deals with makers from the Indexer, he can optionally call on an Oracle to receive price information. The Oracle helps both makers and takers make more educated pricing decisions and smooth the negotiation process. Because settlement of the trade ultimately happens on-chain on a peer-to-peer basis, Airswap is able to provide a high level of privacy than its counterparts.

CryptoBridge is a new entry in the decentralized crypto exchange markets. CryptoBridge is a decentralized exchange running on top of the BitShares Network. It supports decentralized trading on all popular altcoin pairs without a single point of failure. You always hold the private keys to your funds, only you have access to them.

But it certainly has some USPs that makes it different than other centralized exchanges such as:-

- It has native BCO token called as BridgeCoin.

- It allows BCO token staking and 50% revenue share with BCO HODlers.

- It has no single point of failures because of its federated servers.

The login process is quite simple where you just need to select a unique username and a cryptographic password will be generated automatically which you need to note down and keep it safe.

How is it different from other projects in the space?

- They provide an off-chain matching engine.

- They have fiat integration.

Which is our winner?

KNC because they are more developed in their roadmap.

Partnerships.

NEX have partnered with Red Pulse, an event-driven research firm headquartered, incorporated, and registered in Hong Kong covering market events impacting Chinese companies, sectors and the overall economy. As part of the partnership, Red Pulse (RPX) will be the first NEP-5 based decentralized application token using the platform. NEX will develop solutions for payment services and will collaborate with Red Pulse on defining standards and APIs for the delivery of these services.

Red Pulse will be one of the first applications to, alongside NEX, bridge the traditional economy users with advanced Blockchain technology allowing professionals on the Red Pulse platform to easily onboard and offboard the RPX token with Fiat in a seamless experience.

NEX ICO MVP.

The trading interface and matching engine launches in Q3 2018.

Conclusion.

Overall we recommend buying NEX because it offers profits and has a staking mechanism. However, we have concerns about their developments so far compared to projects like Kyber.