Presale Date: Ongoing.

Tokenbox ICO Date: 14th November 2017.

Tokenbox is a unique ecosystem that brings together crypto-currency funds under the management of professional portfolio managers and traders on the one hand and investors on the other.

As well as Crypto-Currency Funds, the following types of funds can also be created on the Tokenbox platform:

- Investment funds with active portfolio management (analogue - Mutual fund);

- Index funds, including a token traded on the exchange (analogue - ETF);

- Funds which follow active trading strategies, including Algotrade, robotized trade.

BACKGROUND.

With the development of blockchain technology and the rapid growth of the crypto-currency market, new opportunities appear consistently in the field of investment.

Yet professionals of the crypto market (portfolio managers and traders) are not sufficiently open to potential investors, as they are afraid of the influence of regulators and do not have a set of technical (software) solutions for the most efficient management of funds and interaction with their customers.

The Tokenbox trust management ecosystem seeks to unite investors on the one hand, and crypto-currency funds in the person of professional managers and traders on the other.

HOW IT WORKS.

Investors are to be granted access to the best strategies for managing funds on the Crypto market with a high degree of safety in these processes. Portfolio managers and traders, including professional teams, are to receive a ready-made “box” solution for the creation of their own tokenized funds, operating professionally, transparently and within the applicable legal framework. The technical solutions offered by Tokenbox enable the fund management process and its development in an efficient and technologically safe way.

Thus, investors can make their choice between different legal and audited funds, according to the inherent ratio of risk and return.

BLOCKCHAIN LEVERAGES.

- When a trader is launching their fund, a smart-contract is created for their fund, issuing the ERC-20 standard on the Ethereum platform.

USE CASES.

Benefits to fund managers and traders.

- Engagement with the Tokenbox site within the relevant legislative infrastructure. Tokenbox is an “umbrella” platform hosting funds and traders in a market place format and providing legal incorporation functionality for the creation of funds to facilitate the issue of their tokens and their trading activities in a legal structure, providing funds and traders with efficiencies to optimize their legal spend.

- KYC/AML. Tokenbox will perform or arrange for KYC/AML on investors on behalf of funds and traders, as well the deployment and use of the requisite data verification systems.

- Management of mutual settlements with investors using their own token, on the basis of smart contracts.

- Access to internal and external liquidity. Using internal liquidity facilitates:

- Reduction of transaction costs. If it is necessary to conduct separate operations for the sale and purchase of assets, funds and traders do not need to pay fees for the deposit or withdrawal of funds from the platform’s internal accounts to external trading platforms. Also, internal liquidity will be provided with a smaller commission, compared to the commissions charged by third-party services.

- Increase the level of security. The use of internal liquidity minimizes the volume of crypto assets that are temporarily controlled by external services (exchanges). The risks of technology crashes and delays in the operation of lock-nets during the transaction period are reduced.

External liquidity is provided through access to organized markets (exchanges) with the use of corporate accounts available as a consequence of the fund incorporation functionality, providing increased transaction limits.

- Software for investment management:

- A trading terminal that is adapted to the needs of funds and traders using different strategies (portfolio investment, algorithmic trading, arbitrage operations, active intraday trading, etc.);

- Built-in analytical tools (predictive modules, back-testing and forward-testing of parameters of trading strategies, sentiment analysis, etc.);

- Customer Line and Customer Analytics (for example, fund reports, information messages for customers, as well as analysis of the dynamics of incoming and outgoing investments, the regional affiliation of clients, etc.)

- Access to the market of ICO-campaigns: centralization and corporate approach enable the purchase of the project’s tokens on beneficial terms (bonuses, discounts and guaranteed purchase). Tokenbox plans to provide tokens with access to the platform and also offers tokenization, processing, escrow, security audit, legalization services.

- Marketing support within the overall Tokenbox strategy as well as access to a global investment community with a substantial number of stakeholders.

- A rating system that entitles investors to make a balanced decision while choosing a particular fund. The rating system allows even a small capitalization fund to compete with larger participants, having a similar rating. The rating system enables funds to avoid a situation where investors anticipate particular result from a fund which actually contradicts their strategy.

For example, the fund’s strategy includes in the portfolio only cryptocurrencies with a total capitalization exceeding $ 5 billion. The investor therefore should not expect transactions involving less liquid crypto-assets and, accordingly, riskier investment decisions.

Benefits to private and institutional investors:

- A secure, integrated gateway to the banking system for entry into a decentralised economy utilizing fiat currencies and classical payment systems. Inside the platform, investors can exchange fiat currencies for cryptocurrencies and tokens, as well as conduct reverse operations.

- Multi-currency wallet with the ability to safely store digital assets. The client has the opportunity to create a universal wallet for basic cryptocurrencies and tokens. For the convenience of users, there are two types of wallets for clients:

- “Lite” wallet: in this version of the wallet, the keys are stored on the platform itself with the user’s consent;

- “Professional” wallet: when utilizing this type of wallet, the keys are stored by the user.

- Multi-level Security System:

- All funds and traders, registering in the system as asset managers, are required to undergo due diligence;

- Best practices in the field of computer security, crypto active storage technologies are applied;

- A regular audit of the security system is conducted with the involvement of industry-leading consultants and experts;

- Fund managers and traders do not acquire the right to “own” the assets of a fund and can only create “light” wallets to access client funds (with the storage of access keys on the platform) for the purposes of settling trades, and all assets managed by the traders are owned by the incorporated fund entity or entities and may be held in safe custody by a third party custodian under the direction of Tokenbox.

- The “rating system” and the “advisory” service that support the investor’s decision in selecting the appropriate investment fund on Tokenbox platform.

The main criteria for the rating system:

- profitability of the strategy (retrospective for the selected period, shown at different market phases, etc.);

- risk management (classification of assets, share of capital for the transaction, maximum drawdown for the selected period, etc.);

- a description of the strategy (transparency, credibility, history of strategy implementation).

The “Advisory” service will run iteratively optimized algorithms using investor selected parameters to inform the investor of the optimum criteria for choosing a fund, according to the size of the investment, investment period, experience, risk appetite etc.

- Convenient, modern and intuitive interface. Tokenbox provides mobile, desktop and web versions for various operating systems.

- Access to ICO-campaigns for investors. Tokenbox is an open platform and projects conducting ICO/ITO/TGE post the data about the project in order for the platform users to participate.

Investors have the ability to invest in ICO/ITO/TGE as well as to buy coins/tokens of projects, including from reserved volumes (guaranteed acquisition at a convenient time for the investor).

TBX USES.

- Any fund using the platform is required to maintain 5% of all assets in its portfolio in TBX. For example, a fund or trader plans to invest $1 million of assets through the Tokenbox platform. In this case, the fund must deposit and include at least $ 50,000 in the TBX portfolio, which represents 5% of the entire portfolio value;

- Discounts on Fund’s commission in case of investing TBX tokens;

- Voting system for token holders with increased ratings of the funds:

- Purchase of marketing (advertising services) at Tokenbox platform;

- TBX tokens are requisite for the purchase of specialised analytical instruments and services;

- In certain pre-announced funds it will only be possible to invest via TBX.

ROADMAP.

HOW ADVANCED IS IT?

The Tokenbox team has experience in successfully launching projects in the field of investment management in crypto assets. The current team activity: The Token Fund and CryptoTrader — a popular application from Zerion.

The Token Fund is a tokenized investment fund that allows investment in cryptocurrencies and tokens of a decentralised economy. The management of the fund, mutual settlements with investors and the system of controlling the actions of portfolio managers on the part of investors are managed using the technology of blockchain and smart contracts.

The Token Fund was officially launched on March 24, 2017, and the capitalization of assets under the management of the fund now exceeds $ 2 million, with a first quarter US dollar yield exceeding 227%.

A majority of the Fund’s clients are from Europe, the Middle East as well as other regions of the world. Currently, the fund does not operate with customers from the United States.

Zerion3 (formerly EtherionLab) is a fast growing fintech company specializing in the creation of applications based on blockchain (including DApps). The Zerion team has extensive knowledge in the field of programming and experience in developing smart contracts on the Ethereum platform. The team has successfully provided technical and organizational support to the following projects: Waves, TrueFlip, Humaniq, Po.et.

The company entered the ICO market in 2015, assisting with the ICO platform Waves.

The technological infrastructure of the future Tokenbox Platform has already been developed and is being actively used by The Token Fund. It consists of several main modules:

- smart contracts for the tokenization of funds;

- processing of receipts of investments and the payment of funds to investors;

- system for calculation and control of the value of the fund’s tokens;

- a parser that controls the volume of crypto assets on the balance sheets and follows their market value;

- Individual profitability calculation system for each fund client;

- a purse for storing ETH and tokens of the ERC-20 standard.

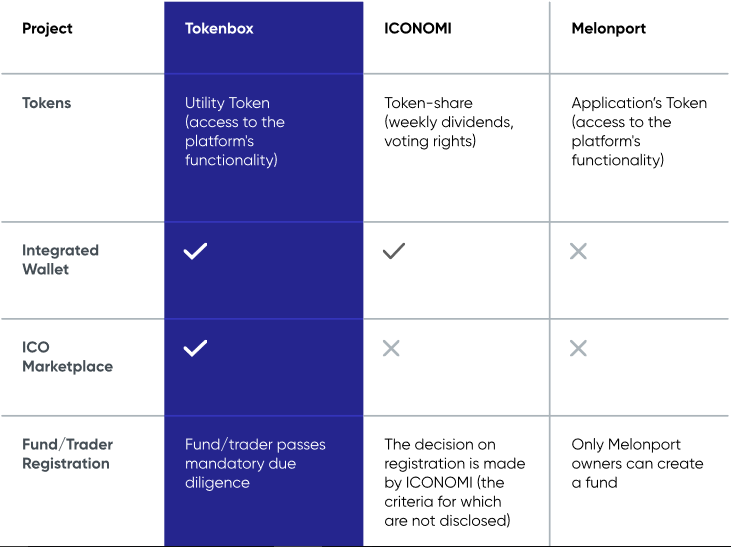

SIMILAR PROJECTS.

Iconomi.

Iconomi, a fin-tech startup based in Slovenia, is building a decentralized management platform to allow funds of tokens to be managed for digital assets. Their goal is to allow any user to create and manage groups of tokens and crypto assets and allow anyone to invest. In exchange for creating and managing these funds, the managers will be paid fees through the platform. This is all according to their original whitepaper that was used to raise $10+ million dollars in an ICO.

So far, it seems like they have built two main products. First, they have created a hedge fund of crypto assets called ICNP where they are actively investing in tokens and other currencies (both crypto and fiat). Second, they have created an index, ICNX, to track the crypto economy and allow users to buy into the index, which is currently in a closed beta.

Melonport.

The open-source Melon protocol will enable distributed digital asset management on the Ethereum blockchain. Anyone can set up, manage, and invest in digital assets. Performance is easily demonstrated and audited. You can invest in other portfolios or have others invest in yours. The core software will support trading multiple tokens through a single interface, while add-on ‘modules’ will open features like price feeds, risk calculation, and KYC compliance.

HOW IS DIFFERENT FROM OTHER PROJECTS IN THE SPACE?

USER REVIEWS.

[Do I understand correctly? Does your project provide an opportunity for future start-ups to place their project within your Tokenbox platform?]

[As far as I understood, yes. But everything is a little more complicated. What you wrote is only part of the opportunities that will work within this platform.]

[I read a little about the project. I understand that it will be possible to invest in fiat funds, right?]

[You can invest in fiat funds in various funds, but this is all after launching the platform. After the project begins to work in full force, when they make their payment system within the project.]

[I read your whitepaper and do not understand one thing, if you already have a similar project The Token Found, why did you need to create a Tokenbox?]

[The Token Found - This is an investment fund. A Tokenbox is an entire ecosystem. This is a universal platform for both the placement of various funds, and for investors. It unites and covers these two sides. It seems to me so.]

[How does the founders of this platform make money for themselves?]

[Part of the commission charged by the funds is utilised as the operating income of the platform Tokenbox. Another source of Tokenbox’s revenue will be

the provision of internal liquidity to funds and traders at a regressive rate (for example 0.25%), depending on the volume of the transaction. External

liquidity (exchanges) is provided according to the retail commission size.]

[When will the platform be launched?]

[In the summer of 2018 (Q3 2018) At least they are so written in the road map]

[As far as I understand, the internal payment system will be integrated inside the platform or, well, like that. It will be possible to pay both with fiat money and crypto currency and tokens, and also convert it all inside the system. And how will rates of different currencies and tokens be calculated?]

[So, is this project and Tokenbox not the same things?]

[Of course not. Tokenbox is an ecosystem for both funds and traders, and for investors. It unites both of them. That is, on the basis of the Tokenbox, there can be a similar project like The Token Fund.]

[So for whom exactly is this project intended (Tokenboks) To create funds, or for investors, or …?]

[This is the feature! It is a unique platform that unites both sides within itself. As investors, so funds and traders. On the basis of this platform, numerous funds will be created, and investors, in turn, will have the opportunity to invest their funds in a particular fund.]

[Looks like a promising project but what’s the logic behind limiting the pre-sale only for people who can pay $USD 50,000 or more?]

[I think, it is a measure to prevent shark influence]

[Within the framework of the platform, a universal purse will be implemented that will support various currencies and tokens. There will be 2 types of purse “easy”, where the keys to the purse will be stored and encrypted on the server, and “professional” where the user will store all the keys in himself.]

[Lol Are you kidding? At the first hacker attack the server will fall and all your money will be lost in an unknown direction! It is best to store the keys in your home, so it’s safer.]

[I do not think so. I think hackers will be easier to hack your personal PC than their server. I am sure that they will have the highest level of security protection]

[And on what platform will all this work? I mean this will be in the form of a WEB application, or will mobile devices be supported?]

[All modern mobile and desktop systems will be supported. PC, Mac, iOS, Android and even VR]

[Recently, many projects do pre-sales and do not provide up-to-date information. Why hide the result?]

[But I do not quite understand why ICO is necessary here. Again, the question is: what can you spend on the tokens?]

[You should not forget that this solution is intended primarily for large investors, and not for ordinary users. Tokens are purchased for access to the project infrastructure in order to adapt their existing fund to the needs of the project]