Kyber Network is a decentralized exchange (of which there has been a recent rush of competing teams) and liquidity platform that allows for instant trading and conversion of cryptocurrency. Meanwhile, users can mitigate their risk in the volatile cryptocurrency world through the use of Kyber Network’s derivatives trading.

This network allows you to convert and exchange your tokens securely and instantly within the KyberWallet. It also supports proxy payments whereby you can pay other ethereum wallet addresses in any token from your own token. The conversion is done and the payment forwarded seamlessly. In the future Kyber Network expects to enable cross-chain payments so that you can receive payments from bitcoin and other cryptocurrencies in Ether.

While services such as Shapeshift and Changelly already exist for conversion of digital assets, Kyber makes it seamlessly applicable to a given smart contract, as well as providing a much larger amount of liquidity for users of the platform (Shapeshift and Changelly at times can have wildly varying spreads due to this problem).

The platform was announced on the internet in May 2017.

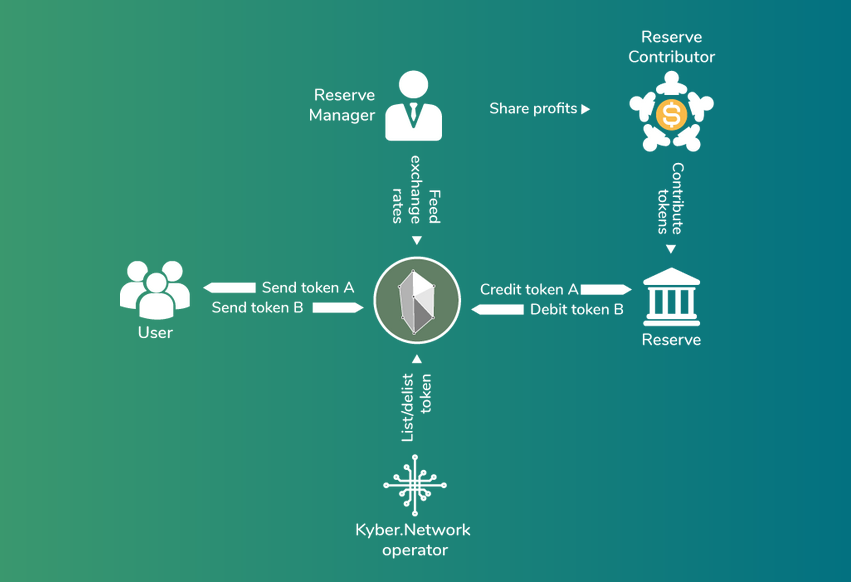

ACTORS IN THE KYBER NETWORK.

There are 5 roles for the actors in the network:

There are 5 roles for the actors in the network:

- Users who send and receive tokens to and from the network. Users in KyberNetwork includes individual users, smart contract accounts and merchants.

- A reserve entity(ies) provides liquidity to the platform. This can be Kyber’s own reserve or other third party reserves that are registered by other market makers. Reserves can also be classified into public and private reserves which do and do not take contributions from the public.

- Reserve contributors who provide capital to the reserve entity and share the platform profit This actor only exists in public reserves which accept contributions from public to build up the reserve.

- Reserve manager who maintains the reserve, determines exchange rates and feeds the rates to the KyberNetwork.

- KyberNetwork operator who is responsible to add and remove reserve entities. Initially the Kyber team will act as the KyberNetwork operators to bootstrap the platform in the early phases. Later on, a proper decentralized governance will be set up to take over the task.

Each of the actors interacts with the smart contract independently in a different way. The users send and receive tokens within a single transaction without waiting for any response from the reserve or the KyberNetwork operator. The KyberNetwork operator is responsible for adding and removing reserves. while the reserve manager determines and feeds the exchange rates to the contract for a fixed period (several seconds basis). The main contract relies on the reserve entity to guarantee high liquidity.

COMPONENTS.

KyberNetwork includes several components, including a user web-wallet, the core smart contracts and a reserve dashboard that helps reserve managers to operate the reserve.

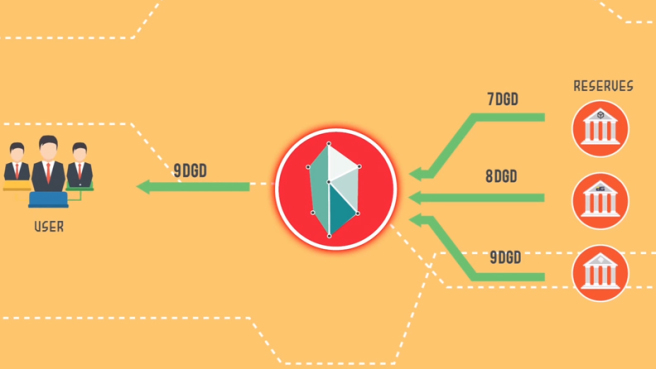

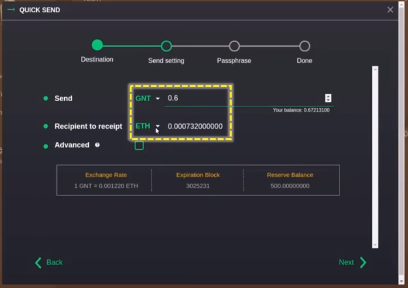

- EDCCs (smart contracts) manage the interaction between reserves and the user. When the user requests GNT in exchange for ETH, the EDCC searches for the best conversion rate among reserves. Once the request for ETH to GNT conversion is received, the contract verifies that the proper amount of ETH has been credited and sends the correct amount of GNT to the address specified by the sender. The amount of ETH, minus fees, is then credited to the reserve that provided the GNT.

- The Kyber wallet allows the Kyber smart contract to send users newly converted tokens to his/ her destination address on the user’s behalf. The destination address will receive the converted tokens as if the tokens were sent from the sender, not the Kyber contract. Kyber will also introduce wallet apps with friendly interfaces to support users. Integrations with existing wallet apps will help improve the adoption of KyberNetwork.

- The reserve manager portal aids the management of the reserve by displaying their performance, network stats, supporting different strategies and algorithms to make prices/ rebalance. Reserve managers interact with the network (or the Kyber contract) via this portal.

- The operator dashboard helps KyberNetwork operator manage the entire system. Operator can add/remove new reserves and change network parameters via this dashboard.

FEATURES.

Liquidity.

Liquidity refers to the extent to which a market allows assets to be bought and sold at stable prices. Lower liquidity tends to result in a more volatile market (especially when large orders are placed), and it causes prices to change more drastically; whereas higher liquidity creates a less volatile market, and prices do not fluctuate as significantly.

Today, cash is the most liquid asset. If a transaction of $1 million takes place, the market is able to absorb that transaction easily without the value of the dollar drastically changing. However, the same transaction in bitcoin, or any other cryptocurrency, has a much greater effect on the cryptocurrency’s value.

This is because of the market’s lack of liquidity. The amount of cryptocurrency available on a specific trading platform can run out, requiring the buyer to complete the transaction at 1–10 percent more than expected.

KyberNetwork introduces a new system for any user to trade any token with guaranteed liquidity by tapping into multiple reserves. KyberNetwork will have its own reserve, commingling with private parties that also supply capital to the reserve.

As the network gains more traffic through collaborations with wallet providers and various other token projects, users will benefit directly from the trading volume due to network effects within KyberNetwork. The result is that KyberNetwork users can instantly trade any asset on the platform.

As the network gains more traffic through collaborations with wallet providers and various other token projects, users will benefit directly from the trading volume due to network effects within KyberNetwork. The result is that KyberNetwork users can instantly trade any asset on the platform.

Interoperability.

Kyber network is designed to present a level of interoperability between a recipient who wants a specific token as a payment and a paying party that does not possess that type of token. KyberNetwork does this using the smart contract that interfaces with wallets, facilitating payments across blockchains without forcing the code to be modified.

Utilizing that protocol, any token that KyberNetwork recognizes can be integrated into any transaction with any wallet – with KyberNetwork acting as an instant exchange between parties. For example an existing wallet that only accepts ETHER but not other tokens, will be able to receive any existing token (e.g. GNT) without having to modify the token contract code (i.e. the recipient is not aware that the payment actually was proxied via KyberNetwork).

This way KyberNetwork enables smart contracts and recipients to access a wider class of users and receive contributions and payments from any token that the platform supports. As an example, any merchant can now use KyberNetwork to allow users to pay in any crypto tokens, but the merchant will receive payments in Ether (eth) or other preferred tokens.

Fast and Secure Transactions.

KyberNetwork is block-instantaneous and it significantly reduces the buffer between when an order is made and when it is filled. As soon as the transaction which initiates the order gets accepted into a block, the trade is confirmed. This feature offers users greater trading security as it eliminates the vulnerability a result of the acceptance window of transactions that could be exploited by attackers. By design, KyberNetwork operator does not hold users’ tokens and orders are enforced by smart contracts, so these tokens are secured from theft losses.

Trustless & Secure.

Every operation on the Kyber Network happens on the smart contract. No trust is required. Kyber Network never holds users’ funds.

Compatibility.

Kyber Network claims to be compatible with existing smart contracts, so no changes are needed to integrate with the Kyber Network. It provides rich payment APIs for different software and projects to run on the network.

On chain.

The main difference between Kyber Network and other digital asset exchanges is that it’s based on blockchain technology. Compared to platforms such as 0x, who do this off-chain, it has a more transparent format. Putting this kind of information on the blockchain can also give valuable data and insight to a company building software on top of their platform, and thus it might have a natural advantage over a more obfuscated off-chain solution.

Hedging Options and Forward Contracts.

The illiquidity of crypto-assets results in highly volatile exchange rates between tokens due to irregular and unpredictable supply and demand. What’s more, unless the trading volume of a token is significant, hardly any exchange would warehouse the tokens, limiting token holders’ options to trade or liquidate a particular token. As a result, it is impossible for token holders to hedge their positions to reduce the risk of adverse price movements in the future.

KyberNetwork addresses this challenge by introducing derivative trading through instruments such as forward contracts. In a forward contract, involved parties agree to execute a trade at a later date at a price specified in the present. Forward contract will be useful in a case where token holders need a specified amount of tokens at a future date.

For example, assuming that Alice has Melon tokens and she wishes to acquire some Ether to invest in an upcoming ICO in three weeks’ time. Her option is either to exchange Melon tokens for Ether now, or she could enter and purchase a forward contract due in three weeks to negate the risk of Ether’s price fluctuations, should she wish to hold on to her Melon tokens for a longer time or she is waiting for an event where she would receive her Melon tokens.

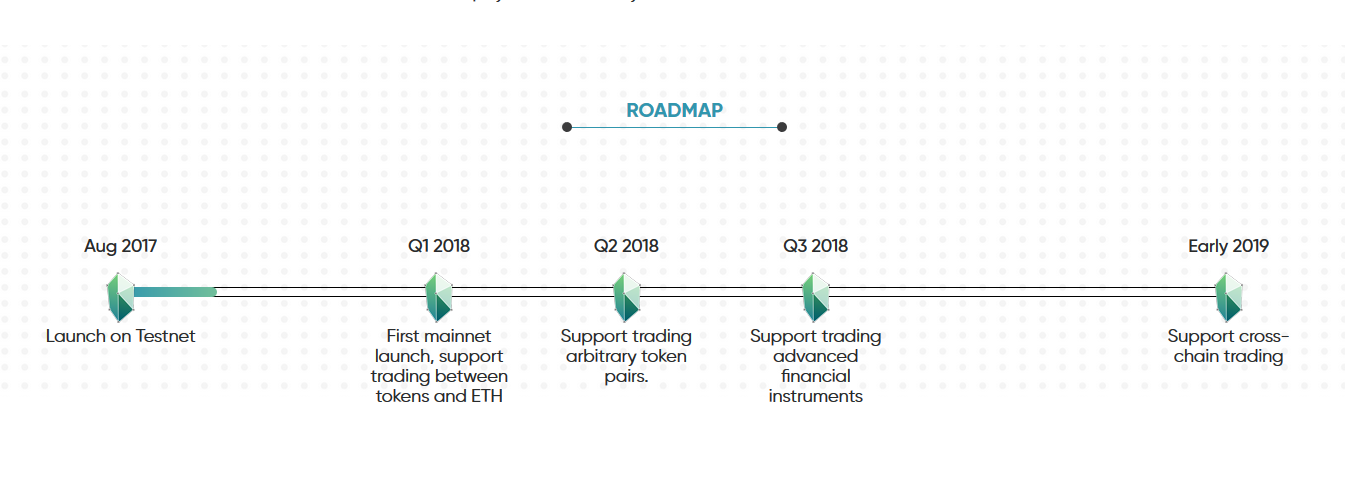

HOW ADVANCED IS THE PROJECT?

In August 2017, the Kyber Network released a minimum viable product (MVP) on the Ethereumtestnet that includes its three major components, including a user web-wallet, the core smart contracts and the reserve dashboard. All of these components are functional in their MVP release and they provide the core functionality that they aim to support in KyberNetwork first mainnet release, scheduled for Q1 of 2018.

That mainnet launch will support trading between tokens and ETH. By Q2 2018, Kyber Network will support trading arbitrary token pairs, and by Q3, they’ll support trading advanced financial instruments. It hopes to support cross-chain trading in an instant exchange by Q4 2018 or early 2019, according to the white paper.

The token sale is over. The tokens are tradable on September 24, 2017.

KYBER NETWORK CRYSTALS.

KyberNetwork Crystal (KNC) tokens are required for reserves to participate in the network and to reward parties that direct traffic and multiply trading activities on the platform.

Knowing the importance of partnerships to scale and improve platform adoption in the blockchain ecosystem, KyberNetwork will collaborate with various organizations, including both software and hardware wallets, blockchain explorers, and on-chain smart contracts to direct users to the platform. As a reward for their efforts, these partners will be paid in KNC for every trade that they introduce to KyberNetwork.

Before operating, KyberNetwork reserves need to pre-purchase and store KNC tokens. In every trade, a small fraction (exact numbers are TBD) of the trade volume will be paid by the reserve to KyberNetwork platform in KNC. This small fee represents the reserve’s payment to KyberNetwork, in return for the right to operate and earn profits from trading activities in KyberNetwork. The collected KNC tokens from the fees, after paying the supporting partners, will be burned, i.e. taken out of circulation and cease to exist forever. In order to determine the network fees, the conversion rate between KNC and ETH will be updated frequently to the Kyber contract by KNC operators, based on the trading rates on various exchanges.

As an example, for a trade volume of 10 ETH with a 0.01% fee, a corresponding 0.001 ETH worth of KNC will be paid by the chosen reserve to KyberNetwork as a fee for the use of the reserve dashboard and access to network users. Suppose the rate of KNC at the trading time is 1 KNC for 0.1 ETH, the reserve needs to pay 0.01 KNC to the Kyber platform. The wallet/ website that helped the user initiate the trade will get, supposedly, 5% of the fees, or 0.0005 KNC. The remaining 95% of the fees, or 0.0095 KNC will be burned and cease to exist in the entire ecosystem.

With this approach, should the adoption of KyberNetwork increases in the future, the demand of the token will likely increase as well. Additionally, this approach also properly rewards all participants who help grow the network.

Token distribution and fund raising.

A maximum amount of 226,000,000 KyberNetwork Crystal tokens (KNC) is minted. The token distribution is be shown as below:

- 47% for the company.

- 47% for founders, advisors and seed investors.

- No more than 61.06% for the public from the private sale and public sale.

The tokens for founders and advisors (around 15% of the total tokens) will be vested for 2 years.

Use of funds.

KyberNetwork intends to use the proceeds of the Token Sale as follows:

- 50% to a reserve to be managed by KyberNetwork as a reserve operator.

- 30% for the development and maintenance of the platform service.

- 10% for the operation of and other costs related to maintaining KyberNetwork.

- 10% for marketing and legal costs.

It is critical for KyberNetwork to have and maintain its own reserve as it guarantees the liquidity of the platform prior to the participation of third party reserves. The plan is to first support the popular tokens like OMG, GNT, GNO and REP and a few others. At a later stage when cross chain protocols become more established, the plan is to tokenize other cryptocurrencies (for example Bitcoin, Zcash etc.) on Ethereum to enable trades between ERC20 tokens and different coins. To be able to execute this component, a large initial capital is required in order to provide reasonable liquidity and trading volume. Hence the need for a reserve of 100, 000 ETH.

Wallets.

- Kyberwallet.

- Ethereum token wallets.

PROS.

- This is a has a strong team especially Vitalik Buterin who is one of the advisors for the project.

- As the Blockchain market grows and more crypto assets are being introduced, the need to convert and exchange between crypto tokens is ever increasing. The trade volume between, for example, ETH and Bitcoin is worth hundreds of million of dollars per day on major exchanges. The total trade volume between ETH and other crypto tokens on its network, most of which are less than 2 years-old, is also in the order of millions of dollars.

KyberNetwork will add real value to the current deficient platforms and solve current issues like hacking and loss of funds, insufficient liquidity .

- Phase 3 and Phase 4 of this project are especially interesting with advanced financial instruments trading and cross chain trades which is done either by chain relay (BTCrelay) or interchain communication (through possibly Polkadot and cosmos).

- KyberNetwork closed their ICO whitelist registration three days earlier than planned due to a massive number of registrations. Since the ICO announcement, KyberNetwork reports their community has grown from 4,000 to over 26,000 users, making it one of the largest crypto Slack communities, if not the largest public Slack community in the world.

CONS.

- Kyber’s roadmap has intentions of releasing the first basic version of the network in the first quarter of 2018 – while this is relatively soon, other projects such as 0x are a step ahead of Kyber as they already have their platform out and working. Because of this, Kyber will not be first-to market, and will likely suffer a decreased level of hype coming into this sale.

- Kyber is only selling around 30% of their total tokens to the public as part of their 32 million dollar ICO. This is rather low considering they sold another 30% or so off to presale investors – ultimately this project will be controlled by larger whales, for better or for worse.

- Kyber’s advantage may also be a double-edged sword. On-chain transactions are specifically avoided in most cases simply due to the time it takes to generate proof of work and embed the transaction in a block-chain. It remains to be seen how fast and efficient Kyber will be compared to 0x, and this will be a large deciding factor in the future success of the platform.

- Kyber success is dependent on the development and success of other project communities which include mentioned in whitepaper, melonport, cosmos, polkadot. Thus there’s a big question mark on how far it can go especially to phase 3 and phase 4 of its roadmap with technical development of other projects and liquidity being the main challenges.

CONCLUSION.

Kyber is an interesting project, because it provides another possible platform for software creators and the like to utilize when using the power of the blockchain. It’s likely worth much more than a mere 30 million dollar ICO (100 million max), but the market may simply decide that 0x will fulfill the niche that Kyber is looking to fill just fine by itself. Still, it could work out the other way, or these two projects might both have their own strengths in the space.

Kyber is an interesting project, because it provides another possible platform for software creators and the like to utilize when using the power of the blockchain. It’s likely worth much more than a mere 30 million dollar ICO (100 million max), but the market may simply decide that 0x will fulfill the niche that Kyber is looking to fill just fine by itself. Still, it could work out the other way, or these two projects might both have their own strengths in the space.

Also, this project is still in very early stage with other features such as main net, etc that will be deployed later in stages. Investors need to be aware that long term prices would still depends on the technical development of the project and the actual liquidity Kyber can secure.

Since KNC is expected to be 2-3x ICO price once it hits exchanges, many investors and certain institutional investors will cash out on Kyber after gaining a certain amount of profit, so do expect high volatility in the prices.